Your best GTM investment during uncertain market conditions?

What’s the old saying? Opinions are like something everyone has…some body part…I’m a bit fuzzy on the details, but you get the point. I think.

When it comes to an uncertain or down economy, everyone has an opinion of the best thing to do to weather it.

Some say to invest in acquisition efforts:

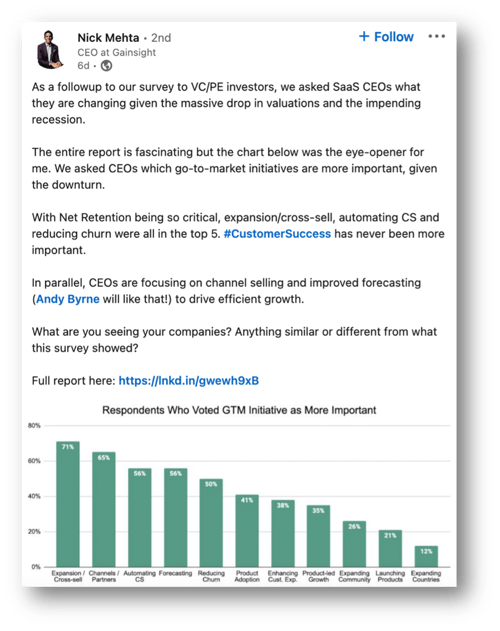

Some say to invest in retention and/or expansion efforts:

Still others say to invest in analytics so you better understand where to invest:

There are many paths

The truth is all these points could be valid.

The cynic in me wants to argue otherwise. It’s not surprising when people suggest you need a solution similar to the one they sell.

The empath in me wants to give these folks the benefit of the doubt. It’s entirely possible they truly believe in the solution they are selling, and that’s why they are devoting their time and effort to it. In that case, their recommendation makes complete sense.

I choose the path of empathy and I assume best intentions. This is why I truly believe all these points could be valid.

Because there are many starting points...

So, what is the best GTM investment during uncertain market conditions? The answer: it depends.

This may seem unsatisfying to some. Or maybe even a copout. It’s not.

The best place for you to invest could depend on:

- The maturity of your market

-

The extent you have product/market fit

-

Whether you have solved your leaky bucket problem

-

How robust your various GTM functions are

-

How accessible your business data is

-

What your competitors are doing

-

And on and on and on…

Your GTM path starts with your clearly articulated goals

Although your investment strategy could depend on many different factors, I do think there are four fundamental truths:

-

Your optimal path depends on your business goals. Be clear about your goals and objectives.

- Cash is king, so you need to focus on revenue generating activities to ensure you have cash on hand.

- Because you need cash on hand, monitoring cash flow is critical.

- You must first solve for customer retention before you invest heavily and/or primarily in customer acquisition. All markets have a finite number of customers, so this is just common sense.

To that last point, monitoring your Net Revenue Retention (NRR) is a great way to determine if it’s time to invest more heavily in acquisition activities. If you find your NRR is lower than you'd like and you decide to solve first for customer retention and customer acquisition, we’d love to chat.

In the meantime, we wish you the best in determining the best place for you to invest in these current uncertain times. Please let us know if there is anything we can do to help!